Trying to make sense of how the Omnicom-IPG deal changes under Trump's FTC

Over the weekend, the FTC announced that is beginning preliminary interviews into the Omnicom-IPG deal that was struck in December. Here's my immediate reaction about the latest on the deal.

Ad agencies (their holding companies, really) are no stranger to mergers and acquisitions. And they’re often massive deals. The merger of Publicis and Omnicom was a proposed $35 billion advertising industry merger that collapsed in 2014. So, let’s talk about one of the big M&A deals that’s been in the news over the past few months, which features Omnicom yet again.

This past December, Omnicom announced a deal to acquire Omnicom for $13.3 billion, combining two of the world’s largest advertising groups to create the world’s largest ad agency. The deal has been expected to close in the second half of 2025, generating approximately $750 million in annual cost synergies. This will likely be done through layoffs. What makes this interesting: President Trump’s FTC’s priorities seem vastly different than the FTC under President Biden.

Let’s dive deeper.

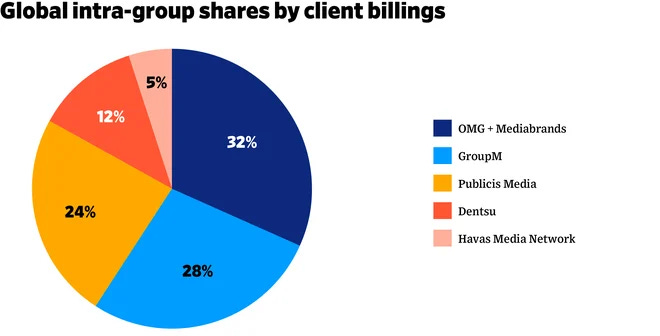

Omnicom CEO John Wren stated that the merger aims to address rapid technical change in advertising, specifically the rise of generative AI. Their merger gives them further leverage in media buying, data analysis, and tech to compete with other rival agencies, such as Publicis and WPP. This merger makes them the largest agency (by client billings) in North + Latin America, and 2nd largest in EMEA + APAC.

Trump’s FTC pick for chairman is expected to be lenient with mergers and acquisitions. And this deal will be one of the first tentpole acquisitions that will test how the FTC under the new regime will act towards advertising at large.

Certain Republicans like Jim Jordan and Elon Musk have accused large ad agencies of collusion against conservative media, with Musk filing antitrust lawsuits claiming organized bias against conservative ideas. X’s lawsuit resulted in the closing of the Global Alliance for Responsible Media, which adds an interesting wrinkle to the future of the deal.

It is highly possible that the ever-influential Musk will weigh in on this topic in the coming weeks as the FTC’s interviews with Omnicom-IPG continue. Ad Age reports that FTC interviews have largely been apolitical so far, though interviews are only in their preliminary phases.

My Reaction:

I think it’s highly likely that this merger will continue forward, but it is also a high-exposure opportunity for Republican-led House Judiciary Committee to exert their influence.

My expectation is that Republicans will seize this opportunity by subpoenaing records from Omnicom & IPG under an FTC investigation that further delves into the “optics” of collusion in a manner that is highly publicized, but ultimately just for show. The companies will likely still merge.

As the owner of an independent creative studio, I can’t help but see this as something that, in the long run, is not particularly sustainable. The competitive advantage for small firms is our adaptability, and large firms specifically struggle to pivot, adapt, and take the time to self-reflect. Their scale becomes their weakness.

Unless we’re talking about media buy. Then, scale becomes Ominicom’s strength, as their agency will get better media deals without their clients knowing the agency’s profit margin or the rights to understand the financials behind the media buys. This is the tough reality for independent agencies. Does this merger really create more value for Omnicom’s clients? I’m struggling to see how it does. One of the largest challenges will be for Omnicom to show their clients how this acquisition will provide cost savings. Does this merger differentiate them from their competitors? Not. at. all.

Overall, I am optimistic about the advertising industry at-large. It’s nice to be small sometimes.

This could very well spell opportunity amongst smaller-budget clients who are seeking a more personalized approach. Being a privately held company, without the constraints of a public company, is a competitive advantage. In fact, independent agencies have retained a largely consistent market share from 2019 to Q1 2024. That’s good news for us independents, and it’ll be crucial to watch this trend going forward.

It will also be an interesting time to track the health of WPP, which loses its status as the world’s largest agency if the deal goes through. They will have to make sure that they’re able to maintain business as usual while also developing AI-enabled capabilities at a rate that is competitive. Will they evolve or will they wither? We’ll have to wait to see. But, they will have the opportunity to improve themselves at a critical moment while their competition undergoes a massive, complex integration.

The unfortunate result of this merger will be massive layoffs for real creatives and marketers. And that’s always the sad takeaway at the end of this conversation. That amazing creative thinkers will lose their roles as a result. Omnicom’s plan forward, once the merger concludes, is to trim, trim, trim employees and other expenditures they deem to be “waste”.

If you’re an independent shop, my recommendation is to keep a careful eye out for the clients and talent that get shaken up in the deal. Seek out the clients & talent that can be poached. The people who will be getting laid off are incredibly well-connected.

Did I miss anything?